The Association of Banks in Malaysia

The Association of Banks in Malaysia (ABM) was formed in November 1973. Our membership is currently made up of the 26 commercial banks operating in Malaysia. Since its inception, ABM has been actively involved in various initiatives to promote and strengthen the commercial banking industry to become more resilient, effective and efficient.

Read MoreNews & Announcements

Get Every Single Update

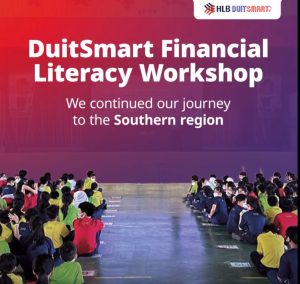

Banks In The Community

Read More

Media Room

Press Releases

ABMConnect provides an avenue for consumers to clarify any doubts and verify information on conventional banking issues.

Connect Now

Loans/Financing Approved by Commercial Banks in Quarter 4 of 2023:

RM

115.5

billion

Commercial banks’ Liquidity Coverage Ratio as at 29 February 2024:

153

%

Loan approvals to SMEs (includes data from the banking system and development financial institutions [DFIs]) in Quarter 4 of 2023:

RM

49.3

billion

Number of employees in the Financial Services Sector as at December 2023:

168,654

employees

Commercial Banks’ Capitalisation Ratio at the end of February 2024:

CET 1 Capital Ratio (%)

14.7

Tier 1 Capital Ratio (%)

15.1

Total Capital Ratio (%)

18.2

Source: Bank Negara Malaysia